More consumers trust Intuit products for their tax prep, small business accounting, and personal financial management than any other brand. 50M Join 50 million people already using TurboTax, QuickBooks and Mint to power their financial prosperity. Official QuickBooks® contact us page. Let us guide you to the quickest answer or QuickBooks expert. Contact us by phone, post a question to the community, or browse our expert FAQs. Intuit works diligently to ensure the accuracy of all federal, state and local taxes calculated by Intuit Online Payroll. In the unlikely event our calculations are incorrect; Intuit. Add Intuit Payroll from QuickBooks to effortlessly pay your employees. Choose from one of several plans that best fits your needs.

Intuit Online Payroll and QuickBooks are two useful business management services. However, each service helps your business in a different way. While Intuit Online Payroll manages the payroll side of your business, QuickBooks handles basic accounting functions. The two payroll software programs work best in complementary roles and are a popular combo for small and medium-sized business owners across the country. Find out how to get free payroll software here for 30 days.

Intuit Online Payroll vs QuickBooks Online How They Help Your Business

Intuit Online Payroll and QuickBooks help your business in different ways. QuickBooks helps manage the accounting and bookkeeping aspects of your business while Intuit Online Payroll lets you accurately pay employees and assess payroll taxes.

If you need payroll software, Intuit Enhanced Payroll is exactly what you need. Intuit also offers a 30 day free trial and its only $2/ per additional employee.

Benefits of Intuit Online Payroll

Intuit Online Payroll is a simple but effective payroll software solution. With Intuit Online Payroll, employers can easily pay employees while accurately deducting payroll taxes and other deductions.

Most businesses already use payroll software. However, even if your business already uses payroll software, Intuit’s easy online system may still save time and enhance the accuracy of your business’s payroll system. Here are the ways in which Intuit Online Payroll will help your business:

Create accurate paychecks for employees: Intuit Online Payroll lets you accurately pay employees. You can pay hourly employees, salary employees, and contract employees in just a few simple clicks.

Pay employees: After creating employee paychecks and assessing deductions, Intuit lets you send out payments. You can pay employees via direct deposit or print checks directly from your office printer.

Assess deductions: Payroll taxes are automatically deducted from employee paychecks according to state and federal law. Employers can also create more deductions based on 401(k), stock purchasing plans, and other company-specific policies.

Process W-2s and 1099 forms: The IRS requires a number of forms from your business. Intuit will notify you when W-2s and 1099 forms are due and can process those forms on your behalf.

Tax accuracy guarantee: Like most payroll software solutions, Intuit guarantees that employee paychecks will be processed accurately an on-time.

Benefits of QuickBooks Online

QuickBooks has been a dominant force since the 1990s and was one of the first accounting software programs that let small/medium-sized business owners manage their own accounting without relying wholly on an accountant.

When you subscribe to QuickBooks today, you’re accessing decades of experience and years of knowledge about business services. The benefits of QuickBooks include:

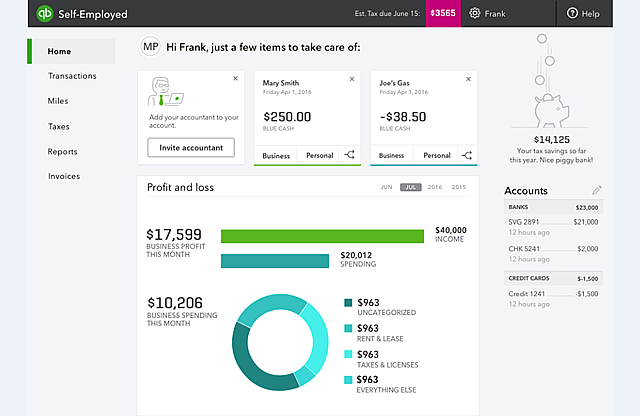

Track income and expenses: QuickBooks Online lets you easily track your business’s income and expenses over defined periods of time.

Bank account synchronization: Synchronize your bank account and credit card accounts to QuickBooks to easily manage and view all business transactions, spent funds, and available funds.

Comprehensive bookkeeping management: QuickBooks is designed to be your business’s one and only bookkeeping service. That’s why it’s loaded with extra features like income and expense tracking, check printing, and many more financial management tools. Not all features are available on all plans, and customers who pay more will receive more bookkeeping features.

Prepare and print 1099s: Not all versions of QuickBooks let you print 1099 forms. 1099 forms are used for reporting payments to contracted employees like consultants and freelance writers. QuickBooks Simple Start and Essentials do not feature 1099 support, but the Plus package does include 1099 support.

Intuit Online Payroll vs QuickBooks Online Supported Services

Mobile apps: QuickBooks offers excellent apps for Android smartphones and tablets as well as iPhones and iPads. Intuit Online Payroll also has apps for Android smartphones and tablets as well as the iPhone, but no iPad app.

Online access: QuickBooks and Intuit Online Payroll can both be accessed online from any internet-connected device. Simply open your browser and login to your account. Downloading apps helps, but it’s not required in order to access your account.

Cloud support: No matter how you access QuickBooks and Intuit, you’re accessing the power of the cloud. All your data is stored on ‘the cloud’, which essentially means you can access it on any internet-connected device.

Compatibility: QuickBooks and Intuit Online Payroll are compatible with one another (the two services are owned by the same company and are designed to complement one another).

Other Points of Comparison On Intuit Online Payroll vs QuickBooks Online

Free Trial: Both Intuit and QuickBooks offer a free trial. Intuit’s free trial lasts for 30 days and requires a credit card. Your credit card will be charged if you forget to cancel your account before the 30 day period is over. QuickBooks does not require a credit card and users also get access to QuickBooks Online Payroll, which is virtually identical to Intuit Online Payroll.

Unlimited Use: QuickBooks lets you create unlimited estimates and invoices no matter which plan you choose (Simple Start, Essentials, or Plus). Intuit Online Payroll charges an extra $2 per month for each additional employee.

Extra fees: QuickBooks does not feature extra fees. The monthly charge you see when you choose your plane is the monthly charge you’ll see on your credit card bill. Intuit Online Payroll is honest about its pricing but users will have to pay extra fees for each additional employee ($2 per month per employee) and an extra fee for each state in which taxes need to be filed ($12 per month per state).

Tech Support: Since Intuit and QuickBooks are owned by the same company, tech support is similar. Intuit, however, has a slight edge due to its comprehensive online support options. Intuit Online Payroll users can access an online database filled with FAQs, ‘how to’ videos, and tutorials. If those helpful resources don’t answer your questions, then you can call tech support directly. QuickBooks does not feature the same comprehensive online database but you can contact tech support directly.

Ease of Use: One of the biggest advantages of both QuickBooks and Intuit Online Payroll is their ease of use. Both services are exceptionally easy to use. Whether you’re running a sole proprietorship or a small/medium business with 50 employees, QuickBooks and Intuit Online Payroll never feel overwhelming to use. A lot of time and effort has clearly gone into making the interface as easy as possible to use.

Employee self-reporting: You can give your QuickBooks login information to multiple users – like department managers – who can control their own bookkeeping information. Or, you can pay to add new users to your plan. On Intuit, you can pay an extra fee to have employees report their own hours online for each payroll period, which can save you a considerable amount of time.

Our Verdict On Intuit Online Payroll vs QuickBooks Online

Intuit Online Payroll and QuickBooks are owned by the same company: Intuit. They’re arguably the two most popular business management programs on the market today.

QuickBooks lets you manage your business and view bookkeeping information, while Intuit Online Payroll lets you accurately pay employees and deduct required taxes.

Bookkeeping and payroll taxes are two required parts of doing business in the United States. Some people enjoy calculating payroll taxes on their own, but most people do not.

Ultimately, Intuit Online Payroll will save your business a lot of money and reduce errors. QuickBooks will simplify your bookkeeping while also saving time. The two services work extremely well together and are popular with business owners across the United States.

Related Reviews:

Payroll Comparisons:

How-to Payroll Articles:

More Payroll Articles:

ViewMyPayCheck is here to help you to access employee pay stubs issued by the employer. It also provides payroll information that may include wages, taxes, gross pay, deductions – you name it.

About ViewMyPayCheck?

There might be question raised in your mind that what ViewMyPayCheck is?

The next-generation online payroll service developed by Intuit to get employee Paychecks – ViewMyPayCheck. There are many services available such as Paycom, UltiPro, Workday HCM, and Paylocity but its unique feature separates it differently. The best part is, it is associated with QuickBooks to offer a cloud-based payroll system.

You can access ViewMyPayCheck from computers/laptops, mobiles, and tablets. It is 100% safe and secure service.

Managing the company’s employee paycheques is not an easy job to do but Intuit ViewMyPaycheck automates pay stub processes quick and easy. It is able to debit current taxes and deductions on time.

Contents

Intuit Payroll

- 5 How to Get Started With ViewMyPayCheck

- 6 Set Up a Payroll in ViewMyPaycheck

- 6.2 Step 2: Create a paychecks for employees:

- 8 Explore ViewMyPaycheck Features

How ViewMyPayCheck Works?

In this section, learn how does ViewMyPayCheck work and how one can use it.

Whether you’re an employer or an HR manager, it offers payroll services to manage their employment payment life cycle more convenient and secure. It can be suited to small or big scale businesses or companies.

Intuit Payroll Sign Up

QuickBooks and Intuit ViewMyPaycheck are working together for you to achieve your business goals – through this web portal.

W-2s can be made through QuickBooks by employers and they send to particular employees via Intuit. And that can be reached to employees a maximum of 48 hours. Learn how to access W-2s online.

Accountants have access to prepare payrolls in QuickBooks application and can be upload paychecks to employees intuit accounts. They have equal functionality as admins have, but they can’t add Administrator access to clients. Payroll Administrator can only have permissions to manage ViewMyPaycheck admins and give access to clients.

Basic Info

ViewMyPaycheck has Moved [Truth Explained]

ViewMyPaycheck portal has a new domain and redirected a new brand site, QuickBooks Workforce.

Despite the ViewMyPaycheck 2 version and several improvements, it has built a strong platform for business and companies over the past years and has moved to QuickBooks with a added features.

The best thing in QB is that it has a mobile applications for employer that makes easier and fast payroll service. It is complete accounting package to do financial transactions such as income, sales, taxes, payroll, W-2, W-3, W-4, etc.

How to Get Started With ViewMyPayCheck

Not sure how to start? Follow the instructions mentioned below from start to end. This module will guide employees to create and access ViewMyPayCheck with ease.

Important Notes for employees before going to register:

– Make sure to check whether your company is using ViewMyPaychek or not.– You must have your Social Security Number (SSN).

– You need to provide the net amount (Net Pay) of the last paycheck from your company.

Part 1: Accept Signup Invitation from Your Employer Via QuickBooks Workforce

We can’t create an account on QuickBooks Workforce (Formally known as ViewMyPaycheck) individually. So, your employer has an option to send a workforce signup invitation. You need to provide an email ID to your employer to get an invite link.

If you’re an employer then learn how to add employees to QuickBooks.

- As soon as your employer added your email address in QuickBooks Workforce’s employee list, you’ll get an invitation request to your Inbox from Intuit Services. If not receive the mail then make sure to check the spam folder or it may be because of the wrong email address.

- Open the email that you received from do_not_reply@intuit.com.

- Click on “Get access to paychecks”.

- Now, you’ll be able to redirect to the QuickBooks Workforce signup page.

Part 2: Signup for ViewMyPaycheck

- Once you’ve landed on the registration section, now you’ll need to create your credentials.

- To do this, Enter your valid email address.

- Create your desired password and rewrite it to confirm.

- Click on the Create Account.

- On the next page, enter your SSN (Social Security Number) and Net Pay amount.

- Click on Submit.

- That’s it.

This is how employees create an intuit account and now let’s get into sign in process.

Part 3: Login to ViewMyPaycheck

- Visit the QuickBooks Workforce homepage (https://workforce.intuit.com).

- Enter your email address and password in the respective fields.

- Click on Sign in button.

- Now, jump into your dashboard and manage our paychecks or pay stubs.

Side Note: The login should be applicable only for those who have already account in it. If not, kindly reach out to part 2 explained above.

Set Up a Payroll in ViewMyPaycheck

QuickBooks Desktop is a simple payroll tool where employers can create and send pay stubs to intuit first and then to workers. Here I’ll let you know how to process payroll with a step-by-step guide. Please follow the below steps as given below without fail.

Step 1: Login into your QB Intuit Account:

If you’re an administrator or an employer then you simply enter your credentials to perform these functions. You only have permission to run a payroll.

- Visit the login page from here.

- Enter your User ID or email address in the first filed.

- Now, enter your password in the second field.

- Click on the Sign In button.

Step 2: Create a paychecks for employees:

Before going to submit the payroll information to intuit, you should create a paychecks for your employees using scheduled or unscheduled payroll run feature.

You might confuse between scheduled and unscheduled payroll types. But, don’t worry about it because these two can be used according to the employer’s situation.

Create Paychecks using QB Online Payroll

- In the Quickbooks, visit the Workers from the left side menu and click on employees.

Optional for Scheduled payroll:

To Create an unscheduled payroll, click on the ▼ dropdown and select Bonus only, Commission only, or benefits only from the list. Next, click on As net pay or As gross pay. Use this quote area when you want to run unscheduled payroll and next follow the respected steps below.- Click on the Run Payroll option.

- In the Bank Account, select the Checking feature.

- Choose and select the Pay period and Pay date.

- Now, select the employees from your list. To remove the particular employees for this paycheck then simply uncheck them.

- Enter custom payroll information such as Pay Method, Salary, Regular Pay Hours, OT Hrs, memos, etc.

- Once you’ve done this, click on Preview Payroll.

- If everything looks correct then you good to go. Click on Submit Payroll.

- Finally, your payroll is run and done.

Create Paychecks by Intuit Online Payroll

This method is quite similar to the above one but using the Intuit online payroll service. You may feel some difference in user interface and options. This is easy and quick method to create paychecks.

- In this Intuit Online Payroll, visit the Payday option.

- Click on the Pay Schedule.

- Choose the type of check you want to use from Regular Check (Scheduled). and Bonus Checks, commissions, Fringe benefits (Unscheduled).

- Make sure to select the employees.

- Give the paycheck information.

- Click on Create Paychecks.

- Now, check out the amounts and payment methods.

- Then, click on Approve paychecks.

Create Paychecks using QB Desktop Payroll

It is helpful for the people who are using the QuickBooks Desktop application.

- In QB Desktop’s header menu, go to Employees -> Pay Employees.

- Now, Choose the check type from scheduled payroll, unscheduled payroll, or termination check.

- Now, enter payroll information: Pay period ends, check date, bank account, and balance.

- Next, click on Check All to select all the employees.

- Click on Open Paycheck details…

- Enter the appropriate information such as Hours, rate, and Hourly.

- After reviewing each employee payroll info.

- Click on Save & Next.

- Click on the Save & Close button to get back to the payroll screen.

- Now, Click the Continue button.

- At last, tap on Create Paychecks option.

I hope you’re created the Paychecks successfully using the above three methods. Let’s learn how to send payroll to intuit servers.

Step 3: Send Payroll to intuit ViewMyPaycheck:

- Open QuickBooks Desktop.

- Go to Menu, Employee >> Send Payroll Data.

- Make sure to check all the data from “items to send” before going to the process.

- Tap on Send All.

- Now, it will ask you to enter your PSP (Payroll Service PIN).

- Tap on OK.

- To see the confirmation messages, visit the Items Received -> View.

- You can save or print these reports for future reference.

- Tap on Close.

How to View W2 and Paychecks in ViewMyPaychecks

Online access to the paychecks & w2s for every employee can be available through the QB workforce of ViewMyPaycheck.

Let’s see how to download, view, and print your paychecks.

- Login to Intuit workforce online portal.

- Go to the Paychecks tab.

- Select to view the latest and prior paychecks details.

- Tap on Download to save/print.

For W2:

- Click on the W2 tab.

- Now, you can see a list of W2 forms(W-2 copies B, C, and 2 from) sent by your employer.

- Click to view or download W2 forms.

Explore ViewMyPaycheck Features

A lot of benefits hidden in this service that you need to explore a bit. We’ve listed you the best features and functions by intuit viewmypaycheck.

Easy Payroll process

VIewMyPaycheck service will automatically streamline the payroll process without hassle. All you need to do is to enter the appropriate information into the online portal including pay rate, hours worked, deductions. Once you’ve chosen the pay period then it calculates the hours worked, net pay, gross pay.

For every pay period, the employer should input this information; How often do you pay? how much do you pay? After submitting this info to intuit, employees will get paychecks as an output to their dashboard. If you want to set the automatic payroll then create a pay schedule. Remember that, there is no bonus and commissions in scheduled payment. All this can be done within minutes.

Payroll Taxes

There are various standards of payroll texes to be filled along with paychecks. They are CA- Disability Employee, Social security employee, Medicare Addl taxes, CA-withholding, and Federal withholding.

W-2 & W-4 forms

Employers can reports year-end earning and deduction to the employees using the W-2 form provided in ViewMyPaycheck. Also, employees can still request tax withhold from their wages using W-4 form.

Download

Select the pay period and download the digital copy of your pay stubs to the computer or mobile. You can take the printout for paper reference using that PDF formatted file.

Notification

Whenever a new payroll runs you’ll get a notification to employee registered email address within seconds.

Filter

View the prior paychecks by choosing particular time period using ‘year to day’ filter.

Mobile App

Intuit offers its users to download the ViewMyPaycheck app for Android and iOS. So that users can access services faster and keep track of their paychecks easily.

FAQ

How do I reset my employee password?

Can’t login to ViewMyPaycheck? You can reset your password by receiving a recovery link to email, OTP to registered phone number, or User ID.

- Visit https://workforce.intuit.com/app/payroll-employee-portal-ui/ius/account-recovery.

By Phone Number:

- Enter a phone number associated with your account.

- Click Continue.

- You’ll get an OTP as SMS for your mobile, Please enter it.

- Now, create a new password.

Via Email:

- Enter your email address.

- Tap on Continue button.

- Open your mail’s inbox and check for password recovery link.

- Click on that link.

- Follow screen steps and create a new password.

User-ID:

- Enter your User ID.

- Click on Continue.

- Now, your password will be sent to your registered email or mobile number.

- Done.

If you still can’t sign or reset password for your account then try this advanced option. You’ll need to provide other questions about yourself.

- Go to “I forgot my user ID or password” page.

- Click on Try something else.

- Enter Last Name, Date of birth, Social Service Number, and ZIP code.

- Select Continue.

- If you gave the correct details then you can make new a password.

Is there a way to see which employees have signed up?

Yes! employers and admins can have a list of registered employees in their dashboard. To see your employees please log in to your account, go to the menu at the top, and select employees.

How to become an admin?

As a client or employee, you can ‘t become an admin yourself. It is only possible for the current administrator of your company. If you’re a current administrator and want to make your client as an admin then your search ends here. See how?

- Once you’ve logged in as an admin for your company in QuickBooks, please go to Employees option on the menu.

- Select the Manage Payroll Cloud Services.

- Be sure to check whether the ViewMyPayceheck is chosen in the Payroll Cloud services tab.

- Now, tap on Manage ViewPaycheck Admins at the bottom of the window.

- Again, you’ve to give your intuit credentials to load your company details.

- Click on Sign In.

- Now, it’ll take you to the Manage users window.

- Tap on Invite Other.

- Fill the form with email id, first name, and last name of that client/employee who wants to act as an admin.

- Tap on the Send button.

Intuit Payroll Api

When you reached the invitation email open the link and follow the screen steps.

How to enable ViewMyPaycheck in QuickBooks?

In QuickBooks, visit this location (Employee > Manage Payroll Cloud Service) and turn on the ViewMyPaycheck feature.

How to signup for my company and add multiple companies to Intuit ViewMyPaycheck?

There are 2 ways to add companies to intuit;

Older method:

- Sign in to intuit account via workforce.intuit.com

- Open “View My Paychecks from another company” tab which is located at the top right of the dashboard.

- Enter the SSN and recent net pay amount of the new company.

- Done.

Newest method:

- Signup for QBO using this link.

- Select your region or country.

- Tap on any one option from Buy or Free 30-Day Trial.

- Choose your plan from this page.

- If you already have a QuickBooks Online account then Click on “Add Another Company”.

- Sign in with your username and password.

- That’s it

How to update employee address in QBO from ViewMyPaycheck?

- Open QBO and go to settings (gear icon) page.

- Click on Custom Form Styles.

- Look for your employee invoice document.

- Click to Edit.

- Open the Content tab.

- Immediately, that PDF doc will appear on the right side. Click the Edit icon.

- Tap on “+ Address” in the header.

- You can enter or modify the employee address here and submit it.

- Done.